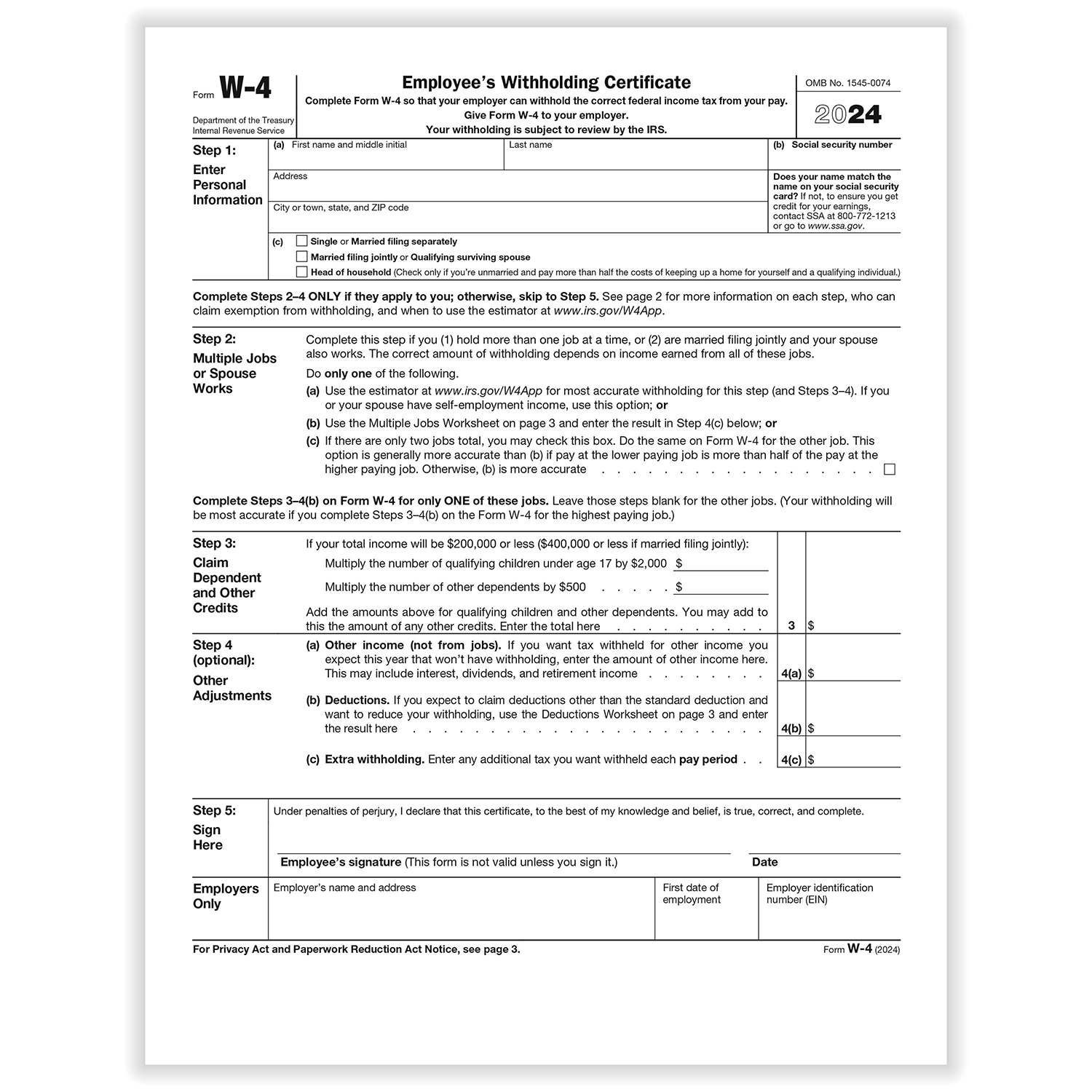

W4 2025 For State – The W-4 form is an Employee’s Withholding Allowance Certificate designed to let your employer know how much of your income to withhold for federal taxes. You should fill out a new W-4 when you have . As of 2025, employers and employees each pay 6.2% for Social Security taxes properly based on how much the employee makes and how they fill out their W-4 form. State payroll tax rates vary. .

W4 2025 For State

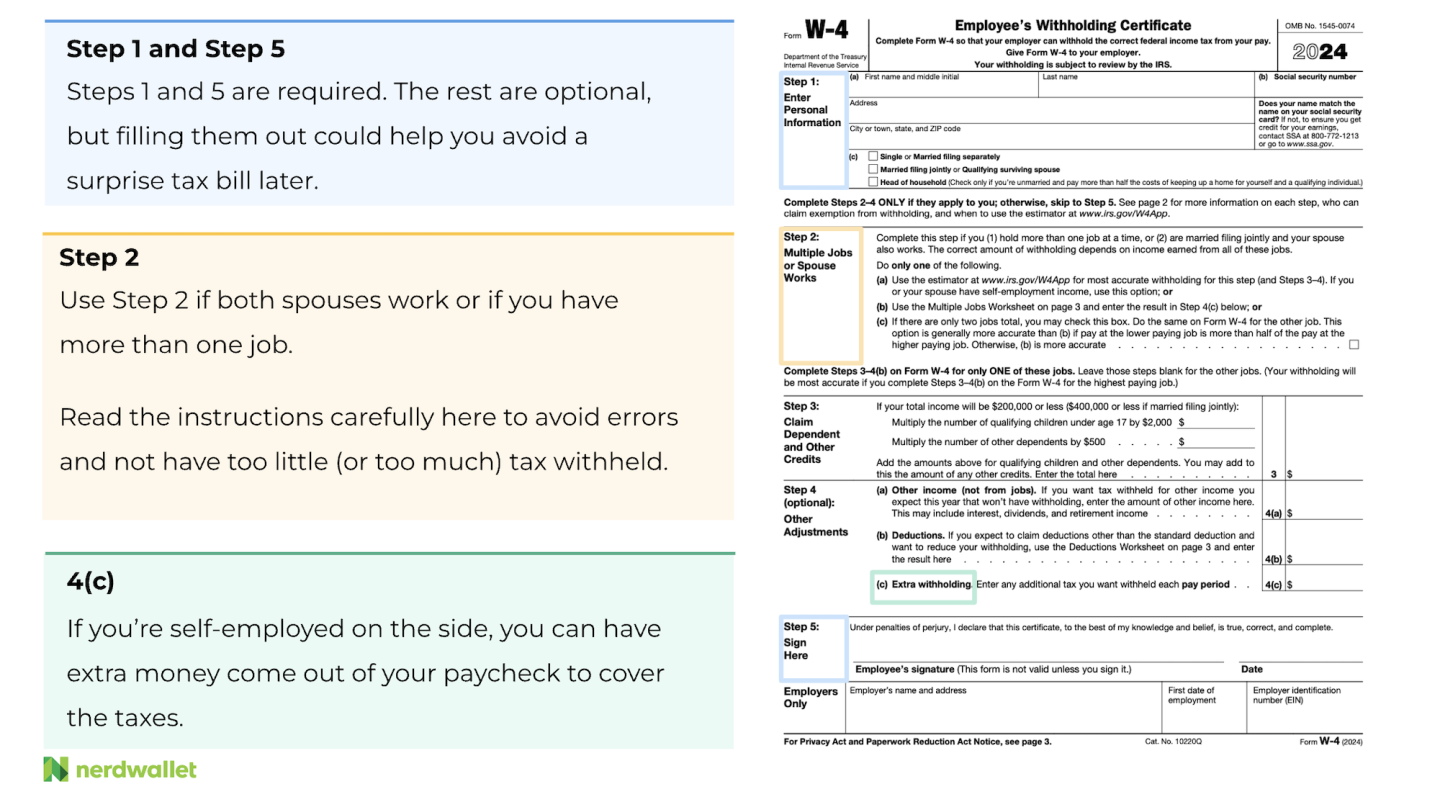

Source : www.irs.govW 4: Guide to the 2025 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comW 4: Guide to the 2025 Tax Withholding Form NerdWallet

Source : www.nerdwallet.com2025 IRS W 4 Form | HRdirect

Source : www.hrdirect.comHere’s How to Fill Out the 2025 W 4 Form | Gusto

Source : gusto.comState W 4 Form | Detailed Withholding Forms by State Chart (2025)

Source : www.patriotsoftware.com2025 Form W 4P

Source : www.irs.gov2025 New Federal W 4 Form | What to Know About the W 4 Form

Source : www.patriotsoftware.comHow to Fill Out the W 4 Form (2025) | SmartAsset

Source : smartasset.comState W 4 Form | Detailed Withholding Forms by State Chart (2025)

Source : www.patriotsoftware.comW4 2025 For State Employee’s Withholding Certificate: There’s a lot to keep track of for tax season this year. Here’s what you need to know about checking your refund status, getting your money quickly and making sure you don’t miss any deadlines in 2025 . Perhaps the most critical day of every legislative session is the announcement of revenue projections for the current and upcoming fiscal year. Having $160 million a year to make up for reduced .